When Snapchat, which makes zero dollars in revenue, turned down a $3 billion acquisition offer from Facebook, the Internet nearly imploded.No way Snapchat can pull this off. It’ll choke on its own hubris, the thinking went.

Snapchat has cornered the ever-important teenage market, but it hasn’t yet revealed how it might help brands advertise to them. The idea of ads that instantly disappear — no chance to play again or click through — seems as ludicrous a novelty as Snapchat itself did at first. (Remember, it’s a sexting app!)

But what if Snapchat is on to something? After all, if there is one thing we’ve learned in two decades of online advertising, it’s that people definitely don’t care about saving ads.

Recall Adkeeper, the startup launched in 2010 to let people save banners. “AdKeeper is ‘on my time’ advertising,” the site declared. The justification behind it was that people enjoy beautiful glossy ads in print magazines. Sometimes they even tear them out and save them. So why wouldn’t they want to do the same thing online?

But that way of thinking — let’s dump everything we do in the offline world directly online, without any sort of adapting to this new medium — has bitten many companies in the ass. Take newspapers, for one. As Katharine Viner, deputy editor of the Guardian, brilliantly explains in a speech last fall, digital media is not just a better word processor enhanced by computers. It’s changing the way we consume media. Bringing analog actions onto the Web requires translation. Henry Blodget, CEO of Business Insider, made the same point at a PandoMonthly last year: “There’s a dramatically different way of storytelling on the Web,” he said. “You don’t have to do something different – it’s just there is a much bigger pallet in terms of storytelling tools.”

Indeed, AdKeeper’s claim that people would want to keep online ads was shaky at best. Banner ads have been widely hated since they were first introduced in 1996. Almost 20 years later, only .01 percent of people actually click on them, let alone cut them out and share them with friends.

Still, AdKeeper couldn’t be dismissed out of hand. The company had a pedigreed founder, Scott Kurnit, who’d sold his media company, About.com, to Primedia for $724 million in 2001. He was the man behind Pay Per View cable and national caller ID. He’s connected, sitting on the boards of Appssavvy and Brightcove, and angel investing in Factual, ShopPad, Britely, ChallengePost, SendMe, and Surphace.

His cachet attracted some of best investors in New York: Spark Capital, betaworks, Lerer Ventures, First Round Capital and The New York Times invested. (NYC outsiders Oak Investment Partners, DCM, and True Ventures also invested.) They gave him $8 million to build the product.

The company’s advisory board was just as impressive: Bob Greenberg of ad agency R/GA, Janet Robinson of The New York Times Company, John Battelle of Federated Media, Jeremy Allaire of Brightcove), Ken Lerer (Huffington Post), Bijan Sabet (Spark Capital), John Borthwick (Betaworks), Wenda Harris Millard (MediaLink), David Rosenblatt (Former DoubleClick), Peggy Conlon (The Advertising Council), David Cowan (Bessemer Ventures), and George Schweitzer (CBS).

Kurnit had worked his industry connections on the advertising side, convincing a long list of them to be named in Adkeeper’s launch press release as “charter advertisers.” Allstate, Ally Bank, AT&T, Best Buy, CBS, Ford, Gap, General Mills, InterContinental Hotels Group, JetBlue, Kmart, Kraft, Macy’s McDonald’s, Pepsi, Sara Lee, Sears, Showtime, Unilever, and Warner Brothers were all on board.

Even so, launch coverage of Adkeeper included a healthy dose of skepticism. “Will you actually save online ads?” MSN Money wrote. Adweek asked, “Is there any way regular Internet users — who on average click banners one time out 1,000 — have any interest in saving banner ads to check out later?”

Only Business Insider, which counts Kurnit as an advisor (a fact that we’ll have to forgive them for not disclosing Apologies: The post does include a disclaimer.), disclosing), managed to fawn over the product, calling Kurnit’s new startup “huge.”

Not surprisingly, advertisers have gone absolutely bananas for it. AdKeeper’s launching with an all-star roster of clients. (And of course they’ve gone nuts–who wouldn’t want their ads “kept”?)

The proposition was thin, which was only made more obvious by Kurnit’s desperation to be taken seriously. He lashed out at any critical feedback, such as a story by Digiday, which quoted four media planners criticizing the product. (It’s no longer online due to a wonky CMS transition.) Kurnit had this to say about the story:

Somehow Digiday chose to quote 4 people we have never met with who know nothing about our business. Worst ‘journalism’ I’ve ever seen. Bizarre.

Meanwhile, to the New York Observer, he predicted his “keep” button would be “bigger than Twitter.” Then, in the New York Times, he raised the stakes impossibly high: “I expect our button to be on literally every ad on the Internet a year from now,” Mr. Kurnit said. “And you can kick my butt a year from now if it isn’t.”

Two months after its launch (private beta only), AdKeeper raised a blockbuster Series A round of funding worth $35 million, bringing its total funds raised to $43 million.

It didn’t even take a year for Kurnit and crew to figure out Adkeeper would definitely not be on literally every ad on the Internet.

In December 2011, Adkeeper changed its name to Keep Holdings and went in a completely different direction, launching a Pinterest clone called Keep. The big difference between Keep and Pinterest is that the stuff on Keep is shoppable, similar to sites like Wanelo.

The Adkeeper product is no longer available; the site now redirects to the homepage of Keep Holdings. It’s a high-profile lesson learned the hard way. Regardless of whether people save print magazine ads, and even if AdKeeper managed to win over ad serving companies and brands, it doesn’t matter: no one wants to save a digital ad.

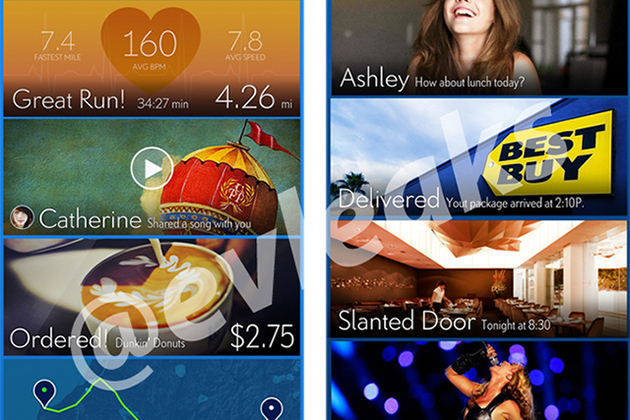

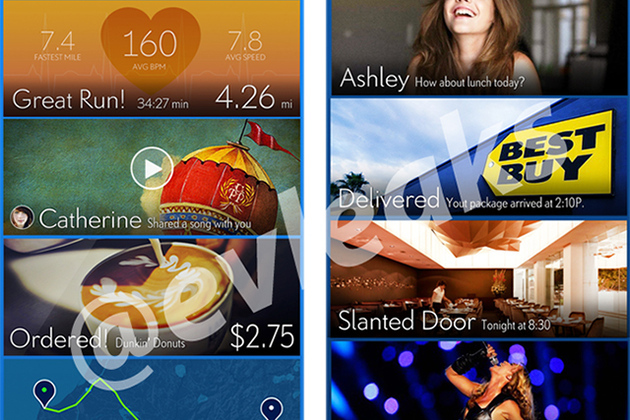

AdKeeper’s story tells us two things. First, don’t listen to even seasoned experts when they tell you a new ad format definitely will or definitely won’t work. There were countless smart people involved in AdKeeper and yet they were all wrong: no-one wanted to save ads. Second, if users hate dwelling on ads as much as they seem to, Snapchat’s now-you-see-it-now-you-don’t platform might be exactly what advertisers, and users, are looking for: commercial messages that feel personal, but don’t outstay their welcome.

There’s definitely something to be said for previewing upcoming products, or sending special content directly to fans for a fleeting moment. As I wrote when Rebecca Minkoff previewed its new fashion line over Snapchat this Fall, this has the potential to be far more engaging than other kinds of marketing message.

Hardcore fans get something special, but only for a few brief seconds. There’s an immediacy to it, as well as a layer of excitement that transcends a boring email, or a Tweet, or a Facebook update — pay close attention so you don’t miss it!

Brands from Taco Bell to GrubHub to MTV have experimented by interacting with fans on Snapchat, none of which have paid Snapchat through any formal advertising program. Yesterday Ad Age revealed that Wet Seal, a teenage clothing chain, had hired a 16-year-oldvideo blogger to help it build a following on Snapchat, accumulating 9000 new followers over a weekend.

This is the biggest sticking point thus far for Snapchat’s momentum: When brands started experimenting on Facebook, the company already had a way for them to spend money: the tiny little banner ads on the side of the page. That eventually blossomed into increasingly large buys, including ads that cost $2.5 million per day. This is the kind of scale brands want and the kind of buys Facebook, an independent public company, needs.

Snapchat has nothing of the sort yet. With the speed at which teens adopt and discard everything in their lives, including popular apps, Snapchat needs to move fast if it wants to capture eager advertisers’ budgets, before they, too, vanish into the ether.

Disclosure: Lerer Ventures is an investor in PandoDaily, as is Josh Kopelman of First Round Capital.

[GIF by Hallie Bateman for Pandodaily. Billboard image via Thinkstock]